Women are the Future of Insurance

As Women’s History Month concludes, we looked at the past, present, and future of women in the insurance industry.

From not being able to purchase a life insurance policy on themselves, in 1841, to making up half of the industry today, what a remarkable journey women had. While progress is happening, it is slow. The Daily Report advises that it wasn’t until 1961 that the United States saw its first Insurance Commissioner. But, decade by decade, they slowly chipped away at the barriers they faced.

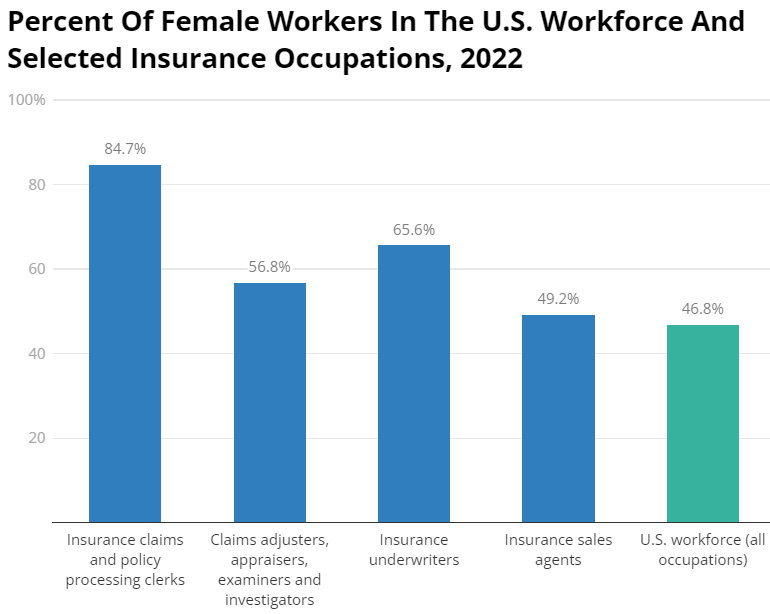

Today, women make up roughly 50% of the workforce in the insurance industry, but only 18% of C-suite executive positions, according to Carrier Management. While driving such a vast portion of the industry, it is amazing that in 2023, women are still struggling for leadership positions.

(Graph from the Insurance Information Institute)

Even at Hastings Mutual, we only recently elected our very first female CEO & President, Renee Beauford. She is the first female CEO & President in the company’s 138-year history. When speaking to Carrier Management, Barbara Bufkin, Chair of the International Board of Governors of the Insurance Industry Charitable Foundation (IICF) and President of the Association of Professional Insurance Women (APIW) stated: “We need to make sure that women’s voices are being heard when they are not in the room … we need to prepare women for executive roles. Giving women strong coaching to be more conscious of their own capabilities and confidence, to overcome ‘imposter syndrome’ and consider themselves for a position when they may not have felt ready for it.”

As we look to the future, and diversity, equity, and inclusion programs grow in all industries, one group of women are often overlooked, in these conversations - women of color. They “hold only 12 percent of entry-level roles and a mere 3 percent of direct-reporting roles to the CEO. That means that black, Hispanic, and Asian women altogether make up only three percent of the insurance C-suite,” reports Carrier Management. To truly champion the female future of the insurance industry, the industry must empower ALL women.

It comes down to more than promoting diversity, equity, and inclusion, too. At the end of the day, women in the insurance industry drive higher profits for their companies. In 2016, Credit Suisse conducted a report, finding that female led companies (wherein 15% or more of senior managers are female) produced profitability at 50% higher than companies where women were in less than 10% of leadership roles. Additionally, female CEOs consistently drive their stocks into outperforming the index. Some of those gains can be up to three or four times the index. The “Swiss Re Institute estimates that a 26 percent increase in global GDP in a scenario of labor market gender parity would yield an additional $2.1 trillion in global insurance premiums by 2029,” as reported by Carrier Management. In essence, more female representation means higher premiums, globally. Yet, Independent Agent Magazine states female Insurance sales staff make 67.6% of men who work in the same role.

These studies are all beneficial, but the lived experiences of women in the industry make them real. CEO & President Renee Beauford weighed in on the matter, in this insightful interview:

- Why is it important for there to be more female representation in the insurance industry?

Representation is extremely important for all industries. We know from research that ethnically and gender-diverse companies are more likely to outperform less diverse organizations. A diverse workforce is more likely to understand our customers’ needs and generate ideas to meet them. We all have different knowledge, perspective, and points of view. When we work together and share those thoughts and ideas, those ideas and actions are more impactful for our company, company culture and our customers. -

What do you think the impact is of being the first female President & CEO of Hastings Mutual, in 138 years?

It can serve as a source of inspiration for women and young women who aspire to leadership roles, breaking down gender stereotypes. I bring new perspectives and ideas to the table, enhancing creativity and innovation within the company. Being the first female president of a company can pave the way for greater diversity and inclusion in the workplace. -

Why is it, personally, important to you that you are the first female President & CEO of Hastings Mutual?

I am proof that women can be president. We need women to see themselves as leaders, and value their own voices and visions. We can find a way to balance a career and family. I have the responsibility and opportunity to use my platform in a way that will encourage others to dream and to aspire and believe in themselves. -

What does the industry need to do to be more accepting of/to promote women in leadership?

The industry needs to provide more mentorship and sponsorship opportunities. Those programs will help women develop the skills and experience necessary for leadership roles. This will in turn build a pipeline of women leaders within the industry. -

What do you think the future landscape looks like for women in leadership, both within the Insurance industry and outside of it?

I think the future of work depends on female leadership. 60% of university graduates are women and half of the US workforce is comprised of women. If we are not smart about how to recruit and retain women, we will be at a talent disadvantage. -

Anything you’d like to add about female involvement in the industry, leadership, or as a whole?

I encourage women to advocate for themselves and obtain the skills necessary to advance. Our society is placing more value on humility and empathy, which is an innate attribute of women.

Independent Agent Magazine advises that over half of the women working in frontline Agency staff positions, under the age of 50, show interest in becoming a partner at their Agency. Renee Beauford’s advice, as well as the advice of so many other women in the industry, is easy- Encourage women, diversify your talent pool, and make space at the C-suite table for women.

Resources:

120 Year Timeline of Women in Insurance

National WIFS (Women in Insurance & Financial Services)

WIFS MI (Women in Insurance and Financial Services, MI)

Labor Force Statistics

Fortune 50 Most Powerful Women

The Mutual Understanding blog and Hastings Mutual videos are made available for educational purposes only. The information referred to is not an official company statement, corporate policy, or offer of coverage. Refer to your insurance policy for specific coverage. There is no representation as to the accuracy or completeness of any information found by following any link on this site. Please contact your local independent insurance agent with further questions and for more details on any insurance policy-related information you read here.

© 2023 Hastings Mutual Insurance Company. All rights reserved.

Related Blog Posts

-

Meet The Women Of Hastings Mutual

Meet The Women Of Hastings Mutual

Meet the women who make your insurance policies happen.

-

Three Ways To Improve Communication At Work

Three Ways To Improve Communication At Work

Start with technology, then take down the silos.

-

How To Research An Insurance Company

How To Research An Insurance Company

Don’t search for answers, find them at Hastings Mutual.

-

Insurance 101 – Key Terms

Insurance 101 – Key Terms

Here’s a little dictionary of some of the most common terms you’ll see and hear when working with Hastings Mutual.

-

The Personal Touch In Insurance

The Personal Touch In Insurance

Why people are as important as technology — maybe even more important.

Hastings Insurance Company

404 E. Woodlawn Ave.

Hastings, MI 49058

Monday-Friday

8:00 a.m. - 4:30 p.m. (EST)

(800) 442-8277

Terms of Use and Privacy Statement© Hastings Insurance Company. All rights reserved.

Leave a commentOrder by

Newest on top Oldest on top