Putting Your Insurance Policies Together

Let your insurance coverage work for you.

It’s called a “bundle,” and it can save you money. Having a Hastings Mutual Homeowners policy, a Personal Auto policy, and a Personal Lines Umbrella policy can help protect you and your family. Having more than one is a bundle. At Hastings Mutual, it means you’re eligible for our multi-policy discount.

Multi-Policy Discount

You can earn a lower rate on both home and auto policies if you have both with Hastings Mutual. There’s also an additional discount on home and auto if you have an umbrella policy. Talk to your local independent insurance agent about the coverage you have and if the multi-policy discount is available to you.

Having multiple policies with Hastings Mutual is just one part of the cost of your coverage, though, so the exact amount you save depends on many different factors.

Streamlined Billing

Low rates are always a positive, but that’s not the only reason to seek out an insurance bundle. If your policies are in different places, with different agents and insurance carriers, that’s a lot for you to keep track of! It’s certainly easier for me to make a single payment and know that everything is paid for that way.

Having your policies all in one place means you can easily check up on them, too, if you need to see the status of your policy or you have a question on your coverage.

The Bigger Picture

One of the benefits of having an insurance agent in your community is that he or she gets to know you and your family. That contributes to the bigger picture of your coverage. It helps your agent select Hastings Mutual insurance coverage that works for your individual situation: the people in your family, the contents of your house, and more.

Your agent can make sure you’re not paying for coverage on things you don’t own and double-check to see if there’s

some kind of coverage you should have but don’t. If your house is insured with one company, and your car with

another,

you could be missing out on discounts and the opportunity to get exactly the coverage you need.

The Mutual Understanding blog and Hastings Mutual videos are made available for educational purposes only. The information referred to is not an official company statement, corporate policy, or offer of coverage. Refer to your insurance policy for specific coverage. There is no representation as to the accuracy or completeness of any information found by following any link on this site. Please contact your local independent insurance agent with further questions and for more details on any insurance policy-related information you read here.

© 2021 Hastings Mutual Insurance Company. All rights reserved.

Related Blog Posts

-

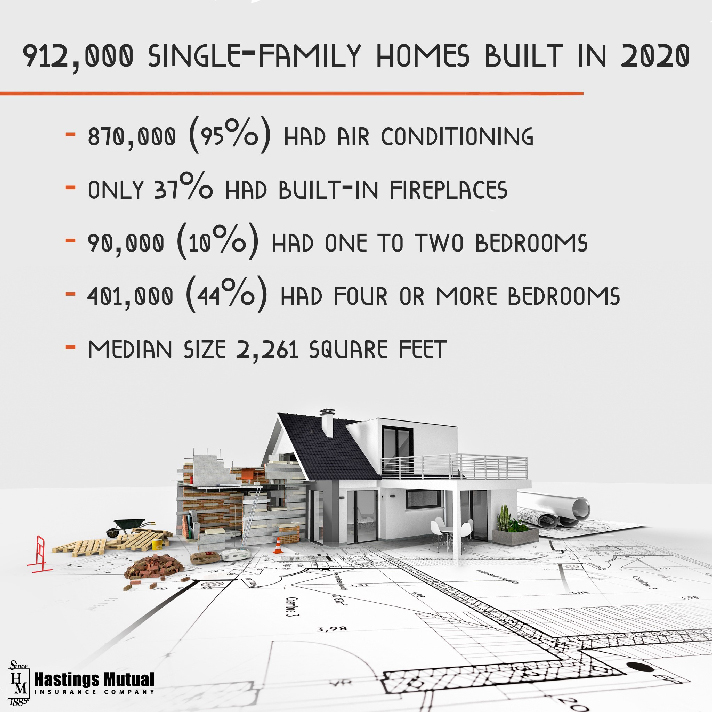

New Houses And The Insurance They Need

New Houses And The Insurance They Need

Building didn’t stop during COVID-19. Here’s a look at what happened.

-

Simple Roof Maintenance On Your Home

Simple Roof Maintenance On Your Home

Make sure your roof doesn’t need “grandpa work.”

-

What Everyone Needs To Know About Insurance

What Everyone Needs To Know About Insurance

Who can you count on for the fundamentals of insurance?

Hastings Insurance Company

404 E. Woodlawn Ave.

Hastings, MI 49058

Monday-Friday

8:00 a.m. - 4:30 p.m. (EST)

(800) 442-8277

Terms of Use and Privacy Statement© Hastings Insurance Company. All rights reserved.